Politics

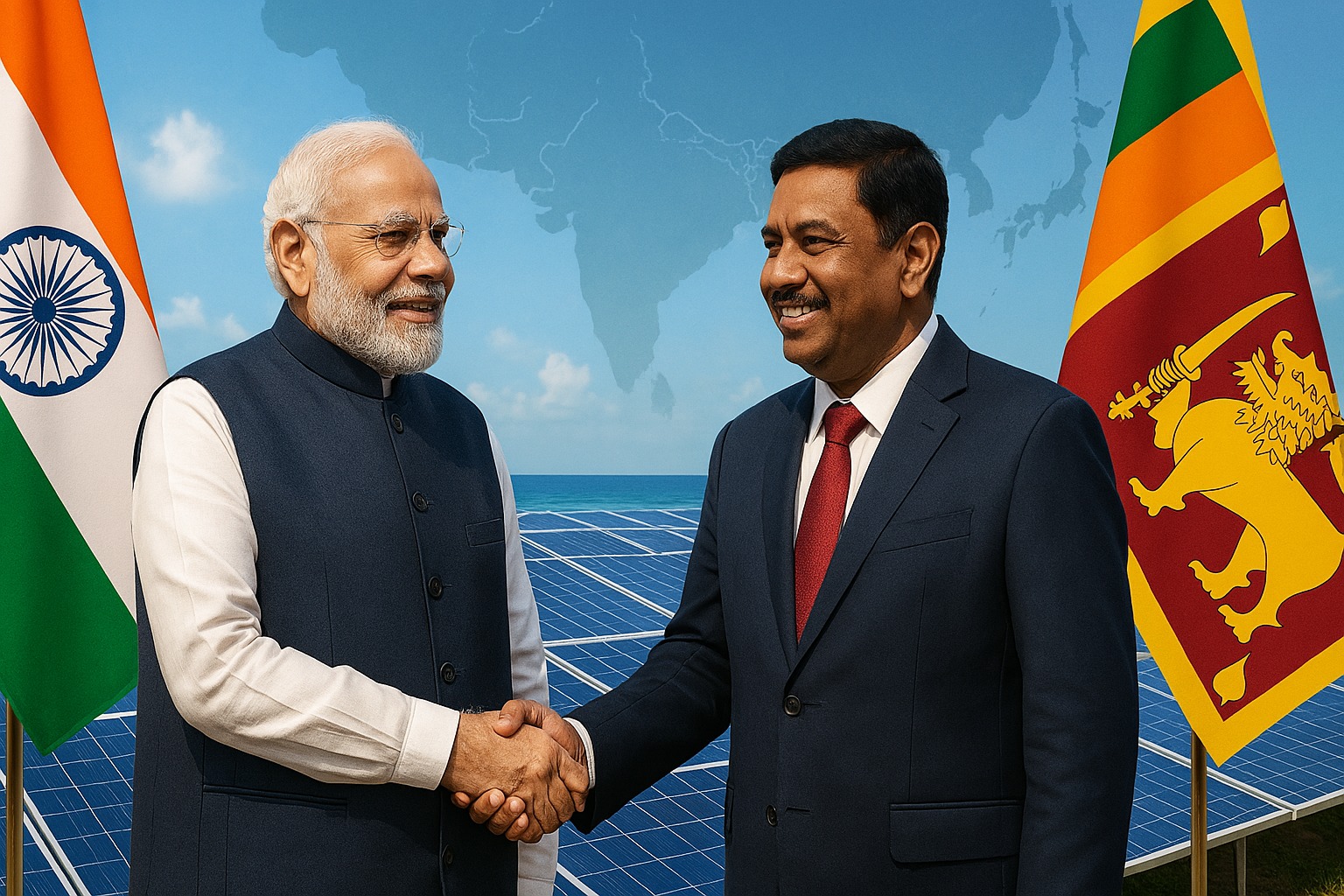

PM Modi Strengthens India-Sri Lanka Ties Amid China’s Expanding Influence

In a move that underscores India’s growing strategic assertiveness in South Asia, Prime Minister Narendra Modi concluded a landmark two-day visit to Sri Lanka, the first official visit by a foreign leader since President Anura Kumara Dissanayake took office. The visit signals a clear intent by India to deepen bilateral cooperation and balance the growing Chinese footprint in the region.

A key highlight of the visit was the joint inauguration of a 120-megawatt solar power plant, representing a milestone in Indo-Sri Lankan collaboration on renewable energy. The leaders also presided over the signing of critical energy and defense agreements, aimed at enhancing regional energy security and maritime cooperation in the Indian Ocean.

The agreements come at a time when Sri Lanka is navigating increasing geopolitical interest, particularly from China. Beijing has made substantial infrastructure investments in the island nation, including control of the Hambantota Port and plans for a $3.7 billion oil refinery. India’s engagement — bolstered by a growing partnership with the UAE, which also joined the initiative to develop an energy hub — is seen as a strategic counterbalance to Chinese influence.

However, the agreements sparked domestic backlash in Sri Lanka, with opposition parties and civil groups protesting in Colombo, alleging that the deals infringe on national sovereignty. The Sri Lankan government has defended its decision, emphasizing that strategic partnerships are essential for the country’s economic revival and energy resilience.

Modi’s visit is being viewed as a continuation of India’s “Neighbourhood First” and “SAGAR (Security and Growth for All in the Region)” doctrines, which aim to strengthen ties with neighboring countries while promoting shared prosperity and stability in the Indian Ocean region.

This visit marks an important moment in the complex yet evolving relationship between India and Sri Lanka. As both countries seek to balance economic development with national interest, the road ahead will depend on sustained diplomatic dialogue, mutual respect, and inclusive strategic cooperation.

Business

India and U.S. Join Forces to Build Semiconductor Fabrication Hubs for Strategic Tech Leadership

India and the United States have launched a joint initiative to develop advanced semiconductor fabrication units within India, focusing on national security and critical technologies. The project aims to strengthen bilateral ties and position India as a strategic player in the global chip supply chain.

In a major leap toward technological self-reliance, India and the United States have agreed to jointly establish a semiconductor fabrication ecosystem in India under the U.S.–India Initiative on Critical and Emerging Technology (iCET). This strategic collaboration will focus on national security use-cases, aiming to reduce dependency on China and bolster supply chain resilience.

As part of this initiative, the two countries will:

- Set up two semiconductor fabs in India

- Establish design and testing centers

- Facilitate technology transfer and investment from U.S.-based semiconductor giants

- Focus on defense-grade and critical application chips, including 28nm and below

The first phase of chip production is expected to go live by 2027, marking a major milestone in India’s effort to become a global hub for advanced electronics manufacturing.

This initiative builds on India’s ₹76,000 crore semiconductor mission and reflects the deepening strategic tech partnership between the two democracies. It comes at a time when global semiconductor shortages and geopolitical tensions have emphasized the need for diversified chip production capabilities.

Officials from both sides have highlighted the importance of this collaboration in ensuring technological sovereignty, boosting defense readiness, and creating high-skilled jobs in India. The move is also seen as a significant boost to India’s “Make in India” and “Atmanirbhar Bharat” (self-reliant India) missions.

The India–U.S. semiconductor deal is being hailed as a milestone in global chip manufacturing strategy, positioning India as a credible alternative to traditional semiconductor powerhouses. With both countries committing to joint R&D and infrastructure investments, the semiconductor fabrication initiative in India is expected to create a ripple effect across tech, defense, and manufacturing ecosystems. Industry leaders believe this could catalyze the rise of a new semiconductor manufacturing hub in South Asia, reducing reliance on volatile supply chains in East Asia.

This collaboration aligns closely with India’s Make in India and Atmanirbhar Bharat goals, signaling a serious push toward self-reliance in critical technology sectors. The focus on producing defense-grade chips and advanced integrated circuits will not only enhance national security but also enable India to contribute meaningfully to global semiconductor supply chains. With growing global demand for strategic tech partnerships, the iCET semiconductor plan is expected to be a cornerstone of future U.S.–India cooperation in advanced technology domains.

With global players increasingly adopting a China-plus-one strategy, India’s inclusion in cutting-edge chip manufacturing could reposition the country as a key player in the 21st-century tech economy.

Business

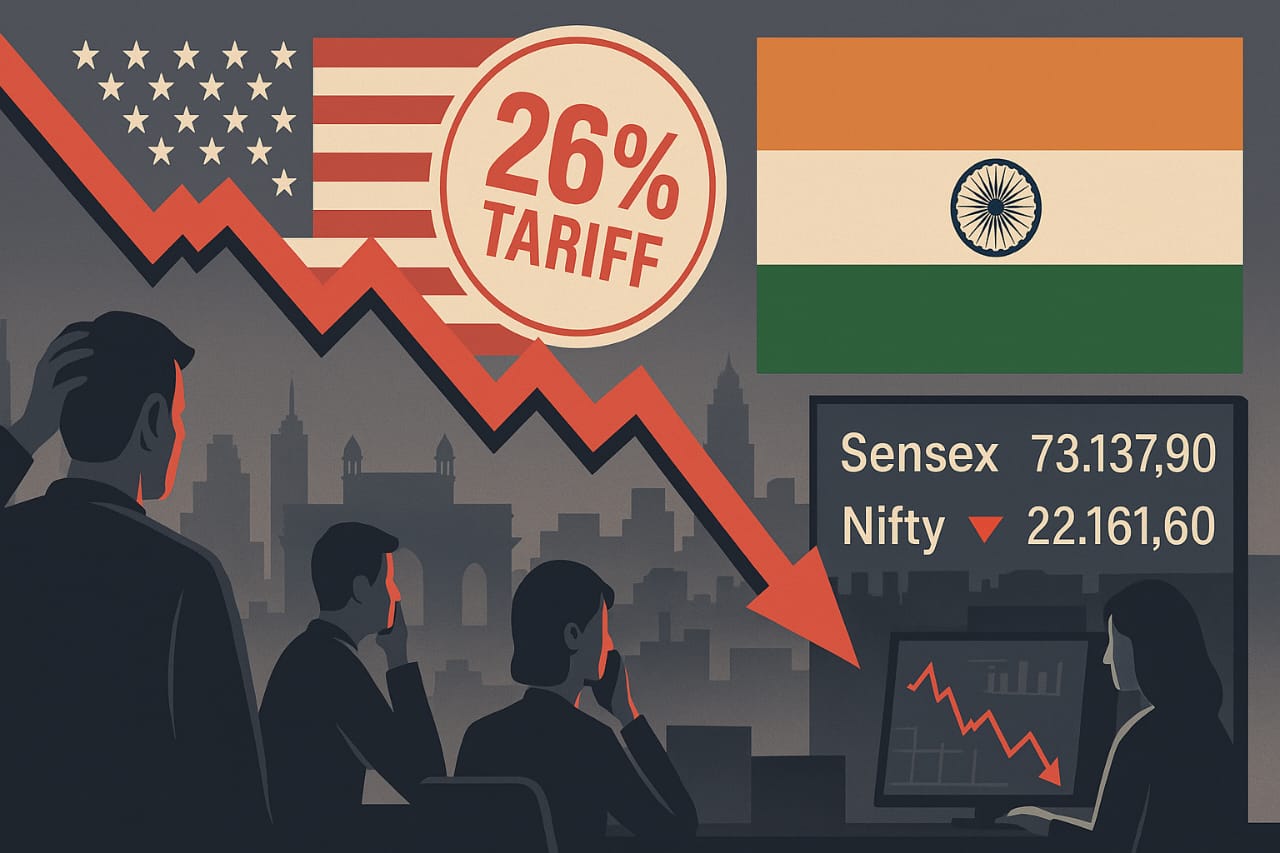

Indian Stock Markets Crash as Global Trade Tensions Spike: Sensex Plunges 2,227 Points

In a dramatic trading session on April 7, 2025, the Indian stock market witnessed its worst single-day fall in ten months, as global trade tensions and recession fears rattled investor confidence. The BSE Sensex nosedived by 2,227 points (2.95%) to close at 73,137.90, while the Nifty 50 fell 743 points (3.24%) to end the day at 22,161.60.This sharp decline was driven by a combination of geopolitical stress, economic uncertainty, and tariff-related pressures, particularly stemming from the United States’ recent decision to impose a 26% tariff on Indian imports.

These events have rekindled fears of a global trade war, further amplified by expectations of a U.S. economic slowdown.

Key Factors Behind the Crash

US Tariffs on Indian Imports: The imposition of steep tariffs by the Trump administration has created anxiety about a potential hit to India’s exports and GDP. Economists suggest this could shave 20–40 basis points off India’s projected growth for FY2025–26.

Volatility Surge: The India VIX, which measures market volatility, spiked by over 56%, indicating heightened fear and uncertainty among market participants.

Weak Global Cues: Global indices were already under pressure due to protectionist measures in the U.S., retaliatory tariffs from China, and concerns about weakening demand across the developed world.

FII Pullout: Foreign institutional investors (FIIs) were seen aggressively offloading shares, putting additional pressure on domestic equity markets.

Sectoral Impact

IT and Pharma stocks took a hit due to their significant exposure to the U.S. market.

Export-heavy sectors like textiles, chemicals, and auto ancillaries also faced selling pressure.Banks and NBFCs declined sharply as rate cut expectations spurred uncertainty in the credit market.—What Should Investors Do? Guidelines for the Way ForwardWith the market shaken, here’s a practical roadmap for retail and institutional investors:

1. Stay Calm, Don’t Panic-SellMarket crashes often present long-term buying opportunities. Avoid impulsive decisions based on fear.

2. Reassess Asset AllocationEnsure your portfolio is well-diversified across asset classes — equity, debt, gold, and cash — to absorb volatility.

3. Look for Value in Quality StocksHigh-quality companies with strong fundamentals often rebound the fastest. Use dips to accumulate leaders in sectors like FMCG, banking, IT, and infrastructure.

4. Keep an Eye on Policy AnnouncementsThe RBI is likely to respond with supportive monetary policies, including potential interest rate cuts to revive sentiment. Monitor any fiscal relief measures by the government.

5. Avoid LeverageRefrain from taking leveraged positions in uncertain markets. Margin calls during downturns can amplify losses.

6. Follow a SIP DisciplineFor mutual fund investors, continue with your Systematic Investment Plans (SIPs). Market volatility can enhance long-term rupee-cost averaging benefits.

7. Seek Professional AdviceIf you’re unsure about navigating current volatility, consider speaking to a SEBI-registered financial advisor.

While the market crash has undeniably rattled nerves, history shows that resilient economies with strong domestic demand like India tend to recover steadily. For investors, the next few weeks will demand discipline, patience, and a long-term perspective.

Business

Dilip Cherian in conversation with Amith Prabhu #CommSPEAK

-

Uncategorized10 months ago

Uncategorized10 months agoRanveer Brar in conversation with Shantanu Prakash | Business Class

-

Business4 weeks ago

Business4 weeks agoMedia in Meltdown: Inside the Financial Freefall of India’s Newsrooms

-

Auto1 month ago

Auto1 month agoIndia’s EV Push Gets a Boost with New ₹5,000 Cr Government Incentive Scheme

-

Business1 month ago

Business1 month agoIndia and U.S. Join Forces to Build Semiconductor Fabrication Hubs for Strategic Tech Leadership

-

Business1 month ago

Business1 month ago‘Frankenstein’ Laptops Rise in Delhi’s Repair Markets as Budget Tech Finds New Life

-

Business1 month ago

Business1 month agoTrump Slaps 26% Tariff on Indian Imports, Triggering Tensions in Indo-U.S. Trade Ties

-

Education2 weeks ago

Education2 weeks agoNEET UG 2025 Admit Cards Released by NTA — Here’s How to Download

-

Education1 month ago

Education1 month ago13 Deeksha Vedantu Students in Karnataka Top 10 Ranks