Business

License Cancelled: The End of the Easy Satellite TV Era in India

Over 250 satellite TV channel licenses have been cancelled or surrendered in India. A closer look reveals structural shifts — from soaring operational costs to the rise of digital-first broadcasting — that are redrawing India’s media landscape.

India’s Ministry of Information and Broadcasting (MIB) has undertaken one of the largest cleanups in recent history, with over 250 satellite television licenses cancelled or voluntarily surrendered between 2018 and 2024.

The data from the Broadcast Seva portal points to an industry shedding its excesses — and bracing for a future where only sustainable, compliant, and agile players survive.

Key Cancellation Trends:

| Metric | Data (approximate) |

|---|---|

| Total Satellite TV Licenses Issued | ~1200+ |

| Total Cancelled/Surrendered Licenses | ~250+ |

| Overall Cancellation Rate | ~20% |

| Years with Maximum Cancellations | FY 2020-21 and FY 2021-22 |

1. Non-Operational and Dormant Channels

Trend:

Channels that remained non-operational for 90+ days without intimation have been cancelled automatically.

Examples:

- Several religious and spiritual channels like Peace TV Urdu (cancelled over security and non-operational issues)

- Bhojpuri regional entertainment channels launched around 2016–2017 failed to sustain and went off-air quietly.

2. Voluntary Surrender by Smaller Broadcasters

Trend:

Many niche broadcasters have voluntarily surrendered their licenses, citing commercial unviability.

Examples:

- Harvest TV — after political ownership tussles and operational challenges, the license was voluntarily given up.

- Real TV (earlier owned by Alva Brothers) — once a GEC entrant, shut down and surrendered operations around 2010s but reflected formally later.

- Small devotional channels like Sant Nirankari Mission TV scaled down satellite ambitions and pivoted to YouTube channels.

3. Regulatory Cancellations: Security and Ownership Issues

Trend:

Security clearance denials and unauthorized transfer of operational control have become grounds for cancellation.

Examples:

- Peace TV (Zakir Naik-linked) — security threat leading to cancellation.

- Some regional political-affiliated channels (not always named publicly) have seen their uplinking licenses revoked over undisclosed ownership changes.

Why the Business Isn’t Viable for Many:

| Problem | Impact |

|---|---|

| High Satellite Carriage Fees | ₹50 lakh–₹1 crore annually per DTH or MSO |

| Low Ad Revenues | 90% of TV ad spend goes to Top 10 networks |

| Cost of Compliance | Legal, audit, MHA clearances cost ₹10–25 lakh+ yearly |

| Changing Audience Habits | Viewers moving to free YouTube and OTT |

| OTT Disruption | Startups prefer launching apps over paying for satellite slots |

Structural Shifts (with Examples):

A. Migration to Digital Platforms

Trend:

Failed or surrendered satellite TV channels are rebirthing as digital-first brands.

Examples:

- Harvest TV’s team pivoted to digital media via news aggregation.

- Regional players like ABP Ganga (which closed satellite operations) now operate as a digital-only regional brand.

- Several religious organizations now prefer YouTube Livestreams rather than costly satellite feeds (eg., Art of Living TV streams).

B. Industry Consolidation by Big Networks

Trend:

Major TV networks are rationalizing regional and genre expansions.

Examples:

- Zee Entertainment merged/surrendered non-performing regional licenses post-merger talks with Sony.

- Network18 (News18 Group) consolidated many smaller regional news channels into larger “News18” hubs (like News18 Lokmat, News18 Gujarati).

- Sun TV Network shifted strategy from launching multiple feeds to focusing more deeply on their dominant Tamil and Telugu markets.

C. Strategic Exit from Non-core Channels

Trend:

Business houses are exiting broadcasting sidelines to focus on digital ventures.

Examples:

- Den Snapdeal TV Shop (a teleshopping channel) was shut and license surrendered as e-commerce moved purely online.

- Smaller teleshopping and astrology channels like Shraddha TV, Divya TV reduced broadcast footprints post-2018 citing high costs.

Impact on the Broadcast Industry:

- From Quantity to Quality:

License cancellations are nudging the industry towards credible, sustainable content players. - OTT Over Satellite:

With JioCinema, Amazon miniTV, and YouTube Channels booming, satellite-first models are now seen as high-risk unless backed by deep pockets. - Rural and Regional Viewers Move to Mobile:

Jio’s cheap data revolution has allowed regional viewers to skip DTH altogether, hurting regional TV’s economics.

Conclusion:

The story of over 250 satellite license cancellations isn’t just a bureaucratic clean-up — it reflects the evolution of India’s media economy.

The old model of launching a channel just to “own a TV brand” is over.

The future belongs to leaner, sharper, digitally native players — and broadcasters who combine strong compliance with strong content.

Business

Over 28,000 Indian Startups Shut Down in Just Two Years — Is the Boom Turning Into a Bust?

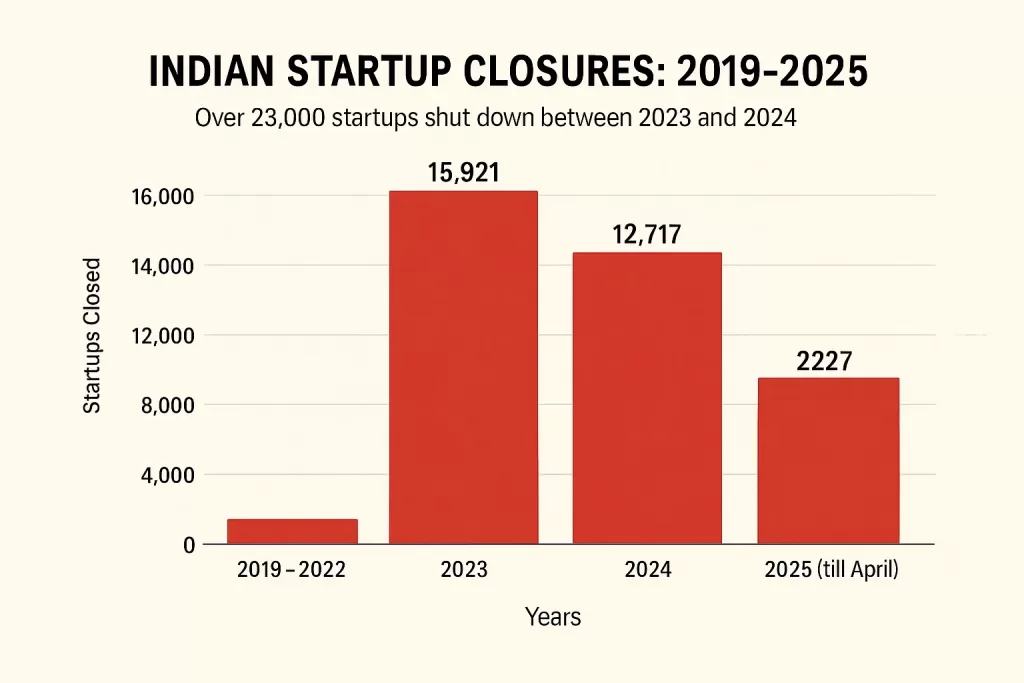

Between 2023 and 2024, over 28,000 Indian startups shut down — a 12-fold increase from previous years. Here’s what triggered the closures and what it means for the startup ecosystem.

India’s startup ecosystem, long hailed as the world’s third-largest and fastest-growing, is witnessing a dramatic correction. According to data accessed from official records and industry estimates, over 28,000 startups have shut down between 2023 and 2024 — a number that dwarfs the 2,300 closures recorded across 2019 to 2022.

This marks a 12x increase in shutdowns over the previous period and reflects the tightening grip of a prolonged funding winter, unsustainable burn models, and macroeconomic headwinds that have hit India’s new-age businesses hard.

📉 Year-wise Startup Closures

| Year | Startups Closed |

|---|---|

| 2019–2022 (combined) | ~2,300 |

| 2023 | 15,921 |

| 2024 | 12,717 |

| 2025 (till April) | 259+ |

(Source: Financial Express, MCA records)

What’s Causing the Spike in Shutdowns?

Experts say the trend is a result of accumulated fragility in the system. Between 2020 and 2021, an avalanche of funding encouraged rapid expansion, but few startups focused on unit economics or real revenue models.

- Funding Slowdown: VC investments dropped by over 40% year-on-year after 2022, forcing cash-strapped startups to either pivot or perish.

- High Burn, Low Return: Business models in edtech, fintech, and quick commerce struggled to maintain customer retention and profitability.

- Regulatory Pushback: Segments like crypto, lending apps, and edtech saw increased oversight, creating compliance pressures many couldn’t absorb.

- Mass Layoffs & Consolidation: Over 24,000 layoffs were recorded in 2023 alone, as firms trimmed operations or merged for survival.

Notable Shutdowns

- Lido Learning: Once a rising edtech player, Lido shut operations in early 2022 due to a capital crunch.

- ZestMoney: A once-prominent BNPL fintech firm that folded in 2023 amid regulatory and operational challenges.

- Udayy: A pandemic-era live learning platform that exited the space in 2022.

- Anar: A B2B SME networking app that shuttered in 2023, citing scale limitations.

Even lesser-known startups in healthtech, crypto, and D2C struggled to maintain runway as customer acquisition costs surged and investor patience wore thin.

The Bright Side? A Market Correction

While the volume of closures is sobering, investors and analysts say the “cleanup” was overdue.

“This is a correction, not a collapse,” said a Bengaluru-based VC partner. “What we’re seeing now is a much-needed shift towards sustainable models, real value delivery, and lean operations.”

New startup launches also slowed in 2024 — with only 5,264 new ventures registered, compared to 9,600 annually during the pre-COVID years.

Conclusion

India’s startup dream is far from over — but it’s becoming more grounded. The age of free cash flow with no profits is ending, and the winners of the next decade will be those who combine ambition with accountability.

Business

Hooked Young: The Growing Drug Crisis Among Youth in South India

From schoolbags hiding MDMA pills to vapes disguised as candy, a silent epidemic is gripping teenagers across South Indian states. Experts warn that the drug supply chain is faster and smarter than ever — and children are the new target.

What began as whispers in hostel corridors has now escalated into a full-blown public health and policing concern. Southern states like Kerala, Karnataka, and Tamil Nadu are witnessing an alarming rise in synthetic drug abuse, with teenagers and young adults at the center of the crisis.

In a recent viral tweet, retired Air Marshal Anil Chopra flagged the disturbing trend: MDMA pills being sold in candy-like packaging, local supply chains delivering narcotics within hours, and children experimenting with highly addictive substances disguised as harmless fun.

The Drugs of Concern

- MDMA (Ecstasy): Marketed under names like Blue Butterfly, Tesla, or Superman, these designer drugs are being distributed in schools and colleges. Often colorful and candy-shaped, they lower inhibitions and increase the risk of dependence.

- Vapes Laced with THC or Synthetic Nicotine: Marketed as “flavored” devices, these are becoming a gateway for school-going children, especially in urban centers like Bengaluru and Kochi.

- LSD Tabs and Cocaine Microdoses: Previously seen only in high-end party circles, these are now available on encrypted Telegram groups with “guaranteed delivery” across Tier 2 cities.

The Modus Operandi: Fast, Digital, Hidden

Dealers are adapting. Using platforms like Instagram DMs, Telegram groups, and even food delivery-style drop services, narcotics are being dispatched faster than pizza. The buyers? School and college students with access to UPI wallets or crypto payments.

Ground Reports: What Police and Parents Are Saying

In Kerala, over 3,000 drug-related arrests were made in 2023 alone — a large number involving juveniles. A senior narcotics officer noted, “These aren’t hardened criminals. Many are 15–17-year-olds from decent families, trapped by peer pressure and tech-savvy peddlers.”

Parents are often unaware until too late. “We thought it was an energy drink or a protein supplement,” said one mother from Kozhikode whose son was hospitalized after consuming a THC-infused vape.

Why It’s Spreading

- Peer pressure + social media glamorization

- Easy access through quick delivery models

- Lack of awareness among parents and teachers

- Delayed regulatory enforcement on vaping and new synthetics

What’s Being Done

- Kerala and Tamil Nadu police have launched school-level awareness campaigns

- NCB and local enforcement are tracking crypto-linked drug deals

- New bans on flavored vape imports have been enforced, but black-market supply continues

- Mental health NGOs are stepping in with rehab and counseling support in colleges

Conclusion

This isn’t just a law-and-order issue — it’s a youth emergency. Unless parents, schools, governments, and tech platforms act in unison, a generation risks being lost to addiction dressed in glitter. The need of the hour is not just crackdowns but conversation, prevention, and support.

Business

The Watchdog Within: Why Independent Directors Matter More Than Ever

Independent Directors play a critical role in keeping company boards accountable. But as corporate failures mount, their independence — and effectiveness — is being re-examined.

In the complex machinery of corporate governance, Independent Directors (IDs) serve as internal watchdogs — professionals appointed to a company’s board to ensure that decisions are made in the best interest of all stakeholders, not just promoters or majority shareholders.

But in recent years, India Inc. has witnessed a wave of high-profile board exits, regulatory penalties, and questionable oversight — all of which have raised one question: Are Independent Directors truly independent?

Who Is an Independent Director?

According to SEBI and the Companies Act, 2013, an Independent Director is someone who:

- Has no material or pecuniary relationship with the company

- Is not a promoter or relative of promoters

- Brings professional objectivity and neutral oversight

Public companies (especially listed ones) are required to appoint a minimum number of independent directors, usually one-third of the total board.

Key Responsibilities

- Corporate governance and compliance oversight

- Approval of related-party transactions

- Audit and risk management supervision

- Executive compensation and CEO evaluation

- Safeguarding minority shareholder interests

Why It Matters Now

In an era where corporate frauds, ESG lapses, and promoter overreach have come under scrutiny, the role of IDs has never been more critical.

Recent controversies involving companies in financial services, retail, and media sectors have shown how weak boards — or rubber-stamp directors — can fail to flag risky practices in time. Regulators are now insisting on board accountability, and investors are demanding transparency and ethical leadership.

Challenges They Face

- Lack of real independence: Often, IDs are appointed by promoters or known to key stakeholders.

- Limited access to internal information unless they actively pursue it.

- Tokenism: Some are offered positions for brand value or gender diversity without being involved in core decision-making.

- Liability without control: IDs face reputational risk and legal exposure for decisions they may not have influenced.

A Shift in Culture

Progressive companies are now empowering IDs with:

- Dedicated onboarding and governance training

- Access to internal auditors and key departments

- Clear documentation of dissent or abstentions

- Boardroom discussions beyond rubber-stamp meetings

Platforms like the Institute of Directors (IOD) and Indian Institute of Corporate Affairs (IICA) are also helping build a pipeline of trained, truly independent directors.

Conclusion

As India’s corporate landscape matures, Independent Directors are no longer passive passengers — they are expected to be active navigators. Their ability to speak truth to power may well define the future of corporate governance in India.

-

Business2 weeks ago

Business2 weeks agoMedia in Meltdown: Inside the Financial Freefall of India’s Newsrooms

-

Auto3 weeks ago

Auto3 weeks agoIndia’s EV Push Gets a Boost with New ₹5,000 Cr Government Incentive Scheme

-

Business3 weeks ago

Business3 weeks agoIndia and U.S. Join Forces to Build Semiconductor Fabrication Hubs for Strategic Tech Leadership

-

Business3 weeks ago

Business3 weeks ago‘Frankenstein’ Laptops Rise in Delhi’s Repair Markets as Budget Tech Finds New Life

-

Business4 weeks ago

Business4 weeks agoTrump Slaps 26% Tariff on Indian Imports, Triggering Tensions in Indo-U.S. Trade Ties

-

Uncategorized10 months ago

Uncategorized10 months agoRanveer Brar in conversation with Shantanu Prakash | Business Class

-

Education3 weeks ago

Education3 weeks ago13 Deeksha Vedantu Students in Karnataka Top 10 Ranks

-

Tech4 weeks ago

Tech4 weeks agoIndia Unveils $2.7 Billion PLI Scheme to Boost Electronics Manufacturing and Job Creation