Business

The IBC Loophole: When Insolvency Becomes a Corporate Exit Strategy

India’s Insolvency and Bankruptcy Code was meant to be a recovery mechanism — not an escape hatch. But growing misuse of the resolution process has raised questions about whether IBC is being exploited to shed liabilities without real accountability.

When India introduced the Insolvency and Bankruptcy Code (IBC) in 2016, it was hailed as a landmark reform to resolve corporate distress and clean up the country’s balance sheets. For the first time, lenders had a structured timeline and legal muscle to recover dues from defaulting borrowers. It was a turning point for financial discipline in India Inc.

But less than a decade later, cracks are showing.

Across industries — from media and infrastructure to real estate and retail — a growing number of promoters are voluntarily entering insolvency not just to restructure, but to wash away liabilities and walk away. In many of these cases, operational assets are stripped, employees are left unpaid, and dues to small creditors remain unresolved — even as promoters, through proxies or affiliates, circle back to reclaim assets at discounted rates.

The Strategy Behind the Exit

Legal experts and insolvency professionals point to a pattern:

- Deliberate default or over-leveraging

- Minimal recovery for creditors, often through resolution plans with massive haircuts (sometimes over 90%)

- Promoter-linked entities bidding to buy back assets at a fraction of the original cost

- Employees and vendors left unpaid, with no recourse

- Business resumes under a new name — often with the same ecosystem, client base, and leadership

High-Profile Examples Under Scrutiny

- Infrastructure and real estate firms where large creditors took deep haircuts and promoters retained influence behind new shell entities

- Media companies where broadcast licenses and content libraries were transferred or re-acquired post-resolution, with liabilities to employees, vendors, and content creators left behind

- Retail chains where store networks were rebranded or transferred, while operational creditors got pennies on the rupee

In some instances, the Committee of Creditors (CoC), driven by banks looking to recover whatever they can, approved plans that effectively amounted to settlements of convenience — often raising eyebrows within the insolvency ecosystem.

Why It’s a Problem

- Erosion of trust in the resolution system

- Small vendors and employees suffer, while large lenders settle for low recoveries

- Ethical concerns around backdoor promoter returns

- Potential rise in “strategic defaults” — where insolvency is planned, not forced

What Experts Say

Regulators and insolvency professionals have begun sounding the alarm. There’s growing demand for:

- Stricter scrutiny of resolution applicants to avoid promoter re-entry via proxies

- Tighter timelines and disclosures in the IBC process

- Safeguards for employees and operational creditors, who often remain unsecured

- Public interest audits in high-profile resolutions

The IBC was envisioned as a tool for revival, not a roadmap for reinvention without responsibility. As misuse grows, the line between genuine insolvency and strategic liability dumping continues to blur. If left unchecked, India risks losing the very credibility IBC was meant to create — and with it, the hope of building a cleaner, more accountable corporate culture.

Business

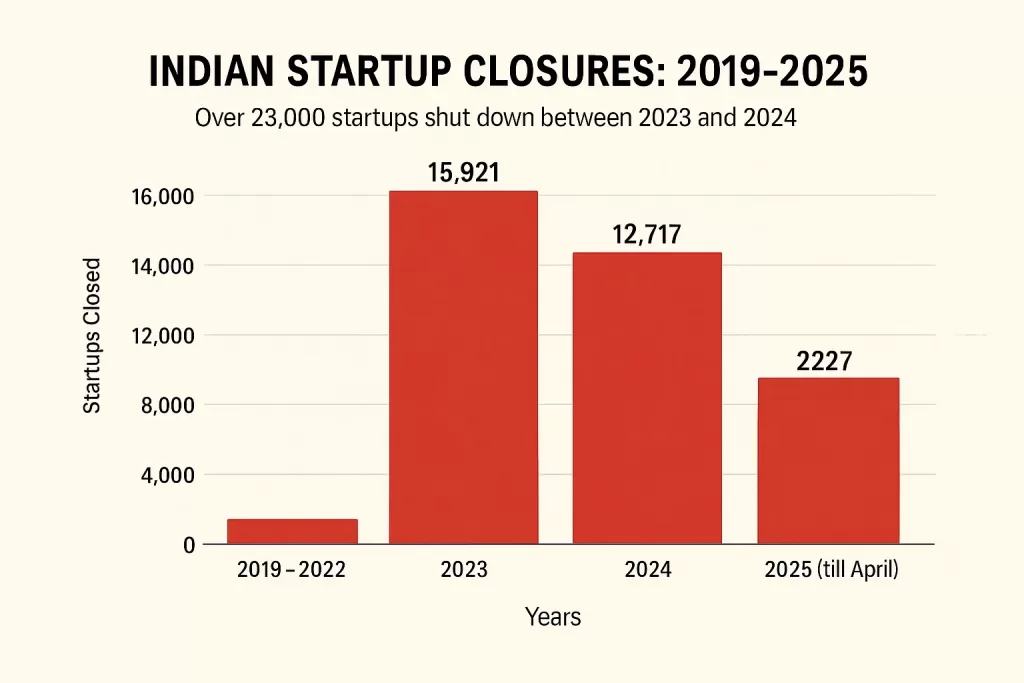

Over 28,000 Indian Startups Shut Down in Just Two Years — Is the Boom Turning Into a Bust?

Between 2023 and 2024, over 28,000 Indian startups shut down — a 12-fold increase from previous years. Here’s what triggered the closures and what it means for the startup ecosystem.

India’s startup ecosystem, long hailed as the world’s third-largest and fastest-growing, is witnessing a dramatic correction. According to data accessed from official records and industry estimates, over 28,000 startups have shut down between 2023 and 2024 — a number that dwarfs the 2,300 closures recorded across 2019 to 2022.

This marks a 12x increase in shutdowns over the previous period and reflects the tightening grip of a prolonged funding winter, unsustainable burn models, and macroeconomic headwinds that have hit India’s new-age businesses hard.

📉 Year-wise Startup Closures

| Year | Startups Closed |

|---|---|

| 2019–2022 (combined) | ~2,300 |

| 2023 | 15,921 |

| 2024 | 12,717 |

| 2025 (till April) | 259+ |

(Source: Financial Express, MCA records)

What’s Causing the Spike in Shutdowns?

Experts say the trend is a result of accumulated fragility in the system. Between 2020 and 2021, an avalanche of funding encouraged rapid expansion, but few startups focused on unit economics or real revenue models.

- Funding Slowdown: VC investments dropped by over 40% year-on-year after 2022, forcing cash-strapped startups to either pivot or perish.

- High Burn, Low Return: Business models in edtech, fintech, and quick commerce struggled to maintain customer retention and profitability.

- Regulatory Pushback: Segments like crypto, lending apps, and edtech saw increased oversight, creating compliance pressures many couldn’t absorb.

- Mass Layoffs & Consolidation: Over 24,000 layoffs were recorded in 2023 alone, as firms trimmed operations or merged for survival.

Notable Shutdowns

- Lido Learning: Once a rising edtech player, Lido shut operations in early 2022 due to a capital crunch.

- ZestMoney: A once-prominent BNPL fintech firm that folded in 2023 amid regulatory and operational challenges.

- Udayy: A pandemic-era live learning platform that exited the space in 2022.

- Anar: A B2B SME networking app that shuttered in 2023, citing scale limitations.

Even lesser-known startups in healthtech, crypto, and D2C struggled to maintain runway as customer acquisition costs surged and investor patience wore thin.

The Bright Side? A Market Correction

While the volume of closures is sobering, investors and analysts say the “cleanup” was overdue.

“This is a correction, not a collapse,” said a Bengaluru-based VC partner. “What we’re seeing now is a much-needed shift towards sustainable models, real value delivery, and lean operations.”

New startup launches also slowed in 2024 — with only 5,264 new ventures registered, compared to 9,600 annually during the pre-COVID years.

Conclusion

India’s startup dream is far from over — but it’s becoming more grounded. The age of free cash flow with no profits is ending, and the winners of the next decade will be those who combine ambition with accountability.

Business

Hooked Young: The Growing Drug Crisis Among Youth in South India

From schoolbags hiding MDMA pills to vapes disguised as candy, a silent epidemic is gripping teenagers across South Indian states. Experts warn that the drug supply chain is faster and smarter than ever — and children are the new target.

What began as whispers in hostel corridors has now escalated into a full-blown public health and policing concern. Southern states like Kerala, Karnataka, and Tamil Nadu are witnessing an alarming rise in synthetic drug abuse, with teenagers and young adults at the center of the crisis.

In a recent viral tweet, retired Air Marshal Anil Chopra flagged the disturbing trend: MDMA pills being sold in candy-like packaging, local supply chains delivering narcotics within hours, and children experimenting with highly addictive substances disguised as harmless fun.

The Drugs of Concern

- MDMA (Ecstasy): Marketed under names like Blue Butterfly, Tesla, or Superman, these designer drugs are being distributed in schools and colleges. Often colorful and candy-shaped, they lower inhibitions and increase the risk of dependence.

- Vapes Laced with THC or Synthetic Nicotine: Marketed as “flavored” devices, these are becoming a gateway for school-going children, especially in urban centers like Bengaluru and Kochi.

- LSD Tabs and Cocaine Microdoses: Previously seen only in high-end party circles, these are now available on encrypted Telegram groups with “guaranteed delivery” across Tier 2 cities.

The Modus Operandi: Fast, Digital, Hidden

Dealers are adapting. Using platforms like Instagram DMs, Telegram groups, and even food delivery-style drop services, narcotics are being dispatched faster than pizza. The buyers? School and college students with access to UPI wallets or crypto payments.

Ground Reports: What Police and Parents Are Saying

In Kerala, over 3,000 drug-related arrests were made in 2023 alone — a large number involving juveniles. A senior narcotics officer noted, “These aren’t hardened criminals. Many are 15–17-year-olds from decent families, trapped by peer pressure and tech-savvy peddlers.”

Parents are often unaware until too late. “We thought it was an energy drink or a protein supplement,” said one mother from Kozhikode whose son was hospitalized after consuming a THC-infused vape.

Why It’s Spreading

- Peer pressure + social media glamorization

- Easy access through quick delivery models

- Lack of awareness among parents and teachers

- Delayed regulatory enforcement on vaping and new synthetics

What’s Being Done

- Kerala and Tamil Nadu police have launched school-level awareness campaigns

- NCB and local enforcement are tracking crypto-linked drug deals

- New bans on flavored vape imports have been enforced, but black-market supply continues

- Mental health NGOs are stepping in with rehab and counseling support in colleges

Conclusion

This isn’t just a law-and-order issue — it’s a youth emergency. Unless parents, schools, governments, and tech platforms act in unison, a generation risks being lost to addiction dressed in glitter. The need of the hour is not just crackdowns but conversation, prevention, and support.

Business

The Watchdog Within: Why Independent Directors Matter More Than Ever

Independent Directors play a critical role in keeping company boards accountable. But as corporate failures mount, their independence — and effectiveness — is being re-examined.

In the complex machinery of corporate governance, Independent Directors (IDs) serve as internal watchdogs — professionals appointed to a company’s board to ensure that decisions are made in the best interest of all stakeholders, not just promoters or majority shareholders.

But in recent years, India Inc. has witnessed a wave of high-profile board exits, regulatory penalties, and questionable oversight — all of which have raised one question: Are Independent Directors truly independent?

Who Is an Independent Director?

According to SEBI and the Companies Act, 2013, an Independent Director is someone who:

- Has no material or pecuniary relationship with the company

- Is not a promoter or relative of promoters

- Brings professional objectivity and neutral oversight

Public companies (especially listed ones) are required to appoint a minimum number of independent directors, usually one-third of the total board.

Key Responsibilities

- Corporate governance and compliance oversight

- Approval of related-party transactions

- Audit and risk management supervision

- Executive compensation and CEO evaluation

- Safeguarding minority shareholder interests

Why It Matters Now

In an era where corporate frauds, ESG lapses, and promoter overreach have come under scrutiny, the role of IDs has never been more critical.

Recent controversies involving companies in financial services, retail, and media sectors have shown how weak boards — or rubber-stamp directors — can fail to flag risky practices in time. Regulators are now insisting on board accountability, and investors are demanding transparency and ethical leadership.

Challenges They Face

- Lack of real independence: Often, IDs are appointed by promoters or known to key stakeholders.

- Limited access to internal information unless they actively pursue it.

- Tokenism: Some are offered positions for brand value or gender diversity without being involved in core decision-making.

- Liability without control: IDs face reputational risk and legal exposure for decisions they may not have influenced.

A Shift in Culture

Progressive companies are now empowering IDs with:

- Dedicated onboarding and governance training

- Access to internal auditors and key departments

- Clear documentation of dissent or abstentions

- Boardroom discussions beyond rubber-stamp meetings

Platforms like the Institute of Directors (IOD) and Indian Institute of Corporate Affairs (IICA) are also helping build a pipeline of trained, truly independent directors.

Conclusion

As India’s corporate landscape matures, Independent Directors are no longer passive passengers — they are expected to be active navigators. Their ability to speak truth to power may well define the future of corporate governance in India.

-

Uncategorized10 months ago

Uncategorized10 months agoRanveer Brar in conversation with Shantanu Prakash | Business Class

-

Business4 weeks ago

Business4 weeks agoMedia in Meltdown: Inside the Financial Freefall of India’s Newsrooms

-

Auto1 month ago

Auto1 month agoIndia’s EV Push Gets a Boost with New ₹5,000 Cr Government Incentive Scheme

-

Business1 month ago

Business1 month agoIndia and U.S. Join Forces to Build Semiconductor Fabrication Hubs for Strategic Tech Leadership

-

Business1 month ago

Business1 month ago‘Frankenstein’ Laptops Rise in Delhi’s Repair Markets as Budget Tech Finds New Life

-

Business1 month ago

Business1 month agoTrump Slaps 26% Tariff on Indian Imports, Triggering Tensions in Indo-U.S. Trade Ties

-

Education2 weeks ago

Education2 weeks agoNEET UG 2025 Admit Cards Released by NTA — Here’s How to Download

-

Education1 month ago

Education1 month ago13 Deeksha Vedantu Students in Karnataka Top 10 Ranks