Business

Indian Stock Markets Crash as Global Trade Tensions Spike: Sensex Plunges 2,227 Points

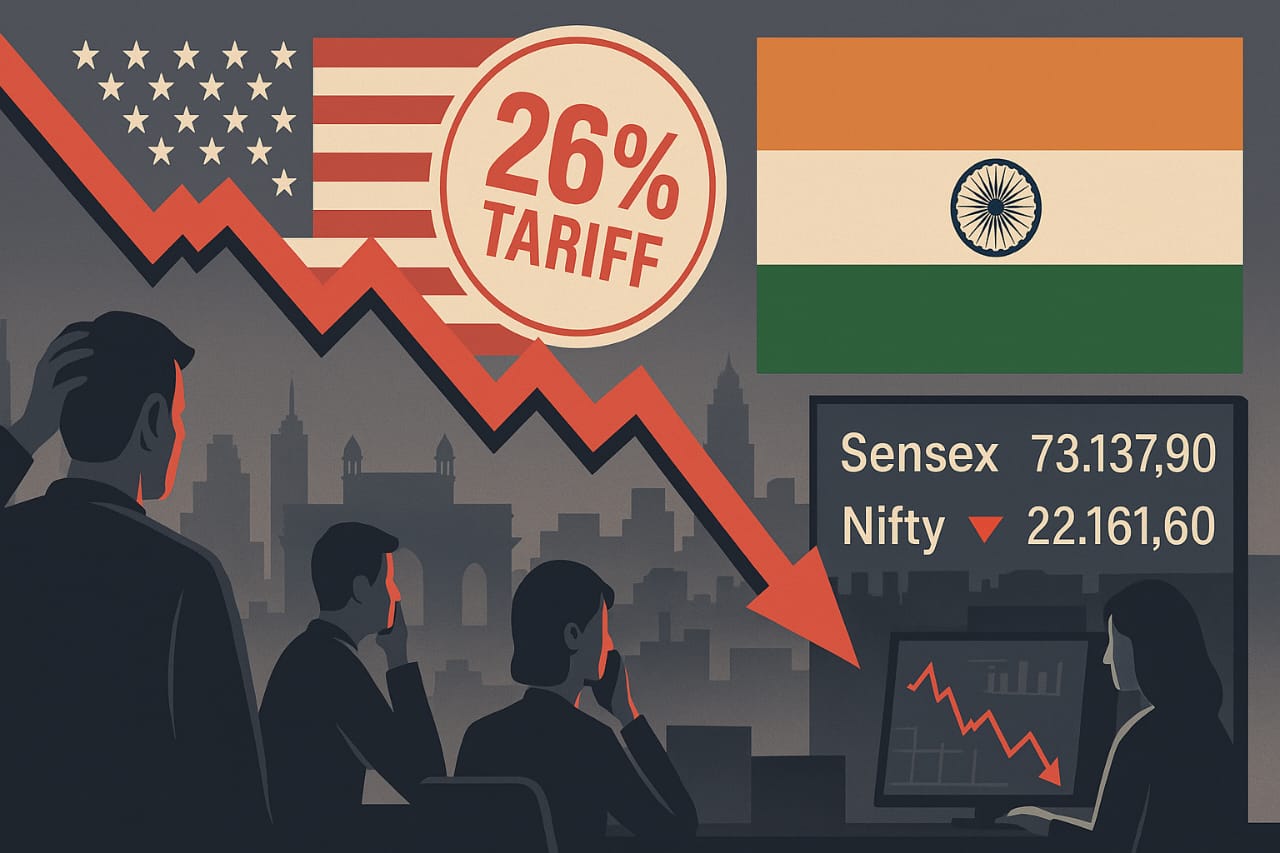

In a dramatic trading session on April 7, 2025, the Indian stock market witnessed its worst single-day fall in ten months, as global trade tensions and recession fears rattled investor confidence. The BSE Sensex nosedived by 2,227 points (2.95%) to close at 73,137.90, while the Nifty 50 fell 743 points (3.24%) to end the day at 22,161.60.This sharp decline was driven by a combination of geopolitical stress, economic uncertainty, and tariff-related pressures, particularly stemming from the United States’ recent decision to impose a 26% tariff on Indian imports.

These events have rekindled fears of a global trade war, further amplified by expectations of a U.S. economic slowdown.

Key Factors Behind the Crash

US Tariffs on Indian Imports: The imposition of steep tariffs by the Trump administration has created anxiety about a potential hit to India’s exports and GDP. Economists suggest this could shave 20–40 basis points off India’s projected growth for FY2025–26.

Volatility Surge: The India VIX, which measures market volatility, spiked by over 56%, indicating heightened fear and uncertainty among market participants.

Weak Global Cues: Global indices were already under pressure due to protectionist measures in the U.S., retaliatory tariffs from China, and concerns about weakening demand across the developed world.

FII Pullout: Foreign institutional investors (FIIs) were seen aggressively offloading shares, putting additional pressure on domestic equity markets.

Sectoral Impact

IT and Pharma stocks took a hit due to their significant exposure to the U.S. market.

Export-heavy sectors like textiles, chemicals, and auto ancillaries also faced selling pressure.Banks and NBFCs declined sharply as rate cut expectations spurred uncertainty in the credit market.—What Should Investors Do? Guidelines for the Way ForwardWith the market shaken, here’s a practical roadmap for retail and institutional investors:

1. Stay Calm, Don’t Panic-SellMarket crashes often present long-term buying opportunities. Avoid impulsive decisions based on fear.

2. Reassess Asset AllocationEnsure your portfolio is well-diversified across asset classes — equity, debt, gold, and cash — to absorb volatility.

3. Look for Value in Quality StocksHigh-quality companies with strong fundamentals often rebound the fastest. Use dips to accumulate leaders in sectors like FMCG, banking, IT, and infrastructure.

4. Keep an Eye on Policy AnnouncementsThe RBI is likely to respond with supportive monetary policies, including potential interest rate cuts to revive sentiment. Monitor any fiscal relief measures by the government.

5. Avoid LeverageRefrain from taking leveraged positions in uncertain markets. Margin calls during downturns can amplify losses.

6. Follow a SIP DisciplineFor mutual fund investors, continue with your Systematic Investment Plans (SIPs). Market volatility can enhance long-term rupee-cost averaging benefits.

7. Seek Professional AdviceIf you’re unsure about navigating current volatility, consider speaking to a SEBI-registered financial advisor.

While the market crash has undeniably rattled nerves, history shows that resilient economies with strong domestic demand like India tend to recover steadily. For investors, the next few weeks will demand discipline, patience, and a long-term perspective.

Business

Drones, Defence, and Disruption: How India’s Drone Tech Is Taking Off

From border surveillance to battlefield support, drones are fast becoming a cornerstone of India’s defence strategy. With government backing and private innovation, the sector is entering a high-altitude growth phase.

India’s push for self-reliance in defence is reaching new heights — quite literally — as indigenous drone technology takes centre stage in both military operations and industrial policy.

Over the last two years, India has significantly accelerated its focus on unmanned aerial vehicles (UAVs) — not just as surveillance tools, but as force multipliers in combat, logistics, and border security.

What’s Driving the Drone Surge

- Defence Ministry Procurements: In 2023–24, the Indian armed forces placed large-scale orders for loitering munitions, tactical drones, and high-altitude surveillance UAVs.

- Make in India Push: Drones are now part of India’s Defence Production and Export Promotion Policy (DPEPP), with incentives for domestic manufacturers.

- Private Players Rising: Startups like ideaForge, Garuda Aerospace, and NewSpace Research & Tech are building combat-ready drones and bagging DRDO, Army, and global contracts.

- Geopolitical Urgency: Post Galwan and escalating tensions with China and Pakistan have made drone-based ISR (Intelligence, Surveillance, Reconnaissance) critical to border defence.

Use Cases in Defence

- Loitering Munitions: Kamikaze-style drones that self-destruct on target — used in tactical ops.

- Drone Swarms: Coordinated UAVs for offensive and defensive manoeuvres.

- Border Surveillance: Continuous monitoring of LOC, LAC, and infiltration-prone zones.

- Logistics and Medical Supply: High-altitude payload delivery in Siachen and remote bases.

Challenges Ahead

- Lack of component-level manufacturing (India still imports batteries, chips, and flight controllers)

- Airspace management and regulation

- Cybersecurity and jamming vulnerabilities

The Global Context

India is now actively positioning itself as an alternative to Israeli and Chinese drone systems, with a target to become a $5 billion drone economy by 2030. Collaborations with UAE, France, and the US are already underway.

The recent export approval of drones to Armenia, and military-grade UAV demonstrations at Aero India and DefExpo, mark a strong shift from consumer drones to strategic assets.

India’s drone sector is no longer just about aerial photography or agriculture — it’s about national security, sovereignty, and battlefield edge. As the skies above become a new domain of warfare, India is gearing up to lead the next era of drone defence innovation.

Business

Over 28,000 Indian Startups Shut Down in Just Two Years — Is the Boom Turning Into a Bust?

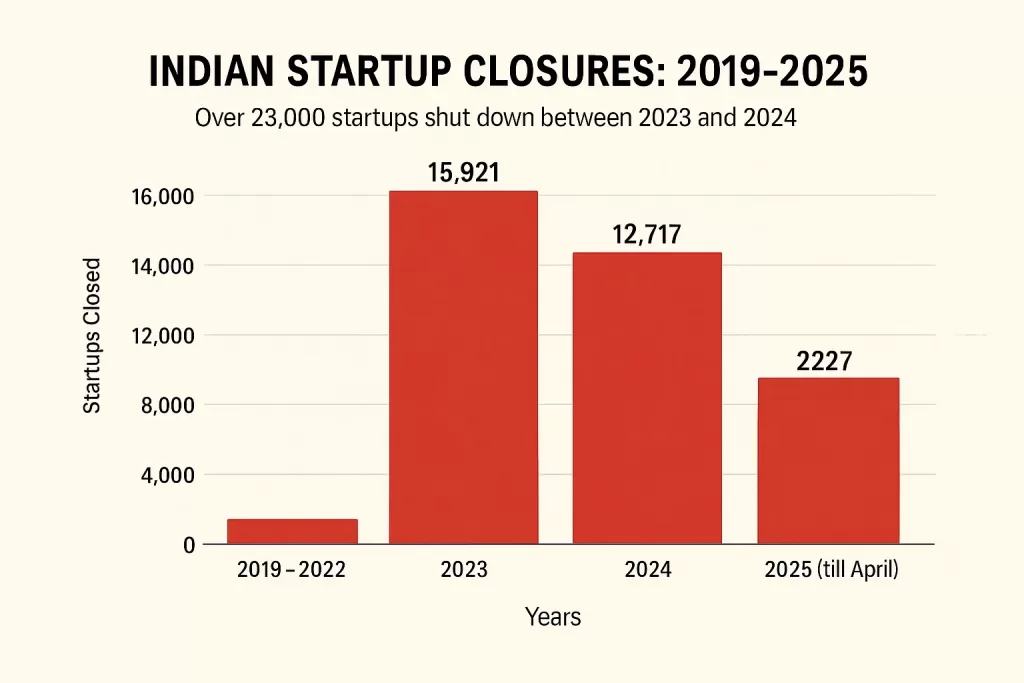

Between 2023 and 2024, over 28,000 Indian startups shut down — a 12-fold increase from previous years. Here’s what triggered the closures and what it means for the startup ecosystem.

India’s startup ecosystem, long hailed as the world’s third-largest and fastest-growing, is witnessing a dramatic correction. According to data accessed from official records and industry estimates, over 28,000 startups have shut down between 2023 and 2024 — a number that dwarfs the 2,300 closures recorded across 2019 to 2022.

This marks a 12x increase in shutdowns over the previous period and reflects the tightening grip of a prolonged funding winter, unsustainable burn models, and macroeconomic headwinds that have hit India’s new-age businesses hard.

📉 Year-wise Startup Closures

| Year | Startups Closed |

|---|---|

| 2019–2022 (combined) | ~2,300 |

| 2023 | 15,921 |

| 2024 | 12,717 |

| 2025 (till April) | 259+ |

(Source: Financial Express, MCA records)

What’s Causing the Spike in Shutdowns?

Experts say the trend is a result of accumulated fragility in the system. Between 2020 and 2021, an avalanche of funding encouraged rapid expansion, but few startups focused on unit economics or real revenue models.

- Funding Slowdown: VC investments dropped by over 40% year-on-year after 2022, forcing cash-strapped startups to either pivot or perish.

- High Burn, Low Return: Business models in edtech, fintech, and quick commerce struggled to maintain customer retention and profitability.

- Regulatory Pushback: Segments like crypto, lending apps, and edtech saw increased oversight, creating compliance pressures many couldn’t absorb.

- Mass Layoffs & Consolidation: Over 24,000 layoffs were recorded in 2023 alone, as firms trimmed operations or merged for survival.

Notable Shutdowns

- Lido Learning: Once a rising edtech player, Lido shut operations in early 2022 due to a capital crunch.

- ZestMoney: A once-prominent BNPL fintech firm that folded in 2023 amid regulatory and operational challenges.

- Udayy: A pandemic-era live learning platform that exited the space in 2022.

- Anar: A B2B SME networking app that shuttered in 2023, citing scale limitations.

Even lesser-known startups in healthtech, crypto, and D2C struggled to maintain runway as customer acquisition costs surged and investor patience wore thin.

The Bright Side? A Market Correction

While the volume of closures is sobering, investors and analysts say the “cleanup” was overdue.

“This is a correction, not a collapse,” said a Bengaluru-based VC partner. “What we’re seeing now is a much-needed shift towards sustainable models, real value delivery, and lean operations.”

New startup launches also slowed in 2024 — with only 5,264 new ventures registered, compared to 9,600 annually during the pre-COVID years.

Conclusion

India’s startup dream is far from over — but it’s becoming more grounded. The age of free cash flow with no profits is ending, and the winners of the next decade will be those who combine ambition with accountability.

Business

Hooked Young: The Growing Drug Crisis Among Youth in South India

From schoolbags hiding MDMA pills to vapes disguised as candy, a silent epidemic is gripping teenagers across South Indian states. Experts warn that the drug supply chain is faster and smarter than ever — and children are the new target.

What began as whispers in hostel corridors has now escalated into a full-blown public health and policing concern. Southern states like Kerala, Karnataka, and Tamil Nadu are witnessing an alarming rise in synthetic drug abuse, with teenagers and young adults at the center of the crisis.

In a recent viral tweet, retired Air Marshal Anil Chopra flagged the disturbing trend: MDMA pills being sold in candy-like packaging, local supply chains delivering narcotics within hours, and children experimenting with highly addictive substances disguised as harmless fun.

The Drugs of Concern

- MDMA (Ecstasy): Marketed under names like Blue Butterfly, Tesla, or Superman, these designer drugs are being distributed in schools and colleges. Often colorful and candy-shaped, they lower inhibitions and increase the risk of dependence.

- Vapes Laced with THC or Synthetic Nicotine: Marketed as “flavored” devices, these are becoming a gateway for school-going children, especially in urban centers like Bengaluru and Kochi.

- LSD Tabs and Cocaine Microdoses: Previously seen only in high-end party circles, these are now available on encrypted Telegram groups with “guaranteed delivery” across Tier 2 cities.

The Modus Operandi: Fast, Digital, Hidden

Dealers are adapting. Using platforms like Instagram DMs, Telegram groups, and even food delivery-style drop services, narcotics are being dispatched faster than pizza. The buyers? School and college students with access to UPI wallets or crypto payments.

Ground Reports: What Police and Parents Are Saying

In Kerala, over 3,000 drug-related arrests were made in 2023 alone — a large number involving juveniles. A senior narcotics officer noted, “These aren’t hardened criminals. Many are 15–17-year-olds from decent families, trapped by peer pressure and tech-savvy peddlers.”

Parents are often unaware until too late. “We thought it was an energy drink or a protein supplement,” said one mother from Kozhikode whose son was hospitalized after consuming a THC-infused vape.

Why It’s Spreading

- Peer pressure + social media glamorization

- Easy access through quick delivery models

- Lack of awareness among parents and teachers

- Delayed regulatory enforcement on vaping and new synthetics

What’s Being Done

- Kerala and Tamil Nadu police have launched school-level awareness campaigns

- NCB and local enforcement are tracking crypto-linked drug deals

- New bans on flavored vape imports have been enforced, but black-market supply continues

- Mental health NGOs are stepping in with rehab and counseling support in colleges

Conclusion

This isn’t just a law-and-order issue — it’s a youth emergency. Unless parents, schools, governments, and tech platforms act in unison, a generation risks being lost to addiction dressed in glitter. The need of the hour is not just crackdowns but conversation, prevention, and support.

-

Business2 months ago

Business2 months agoIndia and U.S. Join Forces to Build Semiconductor Fabrication Hubs for Strategic Tech Leadership

-

Auto2 months ago

Auto2 months agoIndia’s EV Push Gets a Boost with New ₹5,000 Cr Government Incentive Scheme

-

Business2 months ago

Business2 months agoMedia in Meltdown: Inside the Financial Freefall of India’s Newsrooms

-

Business2 months ago

Business2 months ago‘Frankenstein’ Laptops Rise in Delhi’s Repair Markets as Budget Tech Finds New Life

-

Uncategorized12 months ago

Uncategorized12 months agoRanveer Brar in conversation with Shantanu Prakash | Business Class

-

Education2 months ago

Education2 months agoNEET UG 2025 Admit Cards Released by NTA — Here’s How to Download

-

Business2 months ago

Business2 months agoTrump Slaps 26% Tariff on Indian Imports, Triggering Tensions in Indo-U.S. Trade Ties

-

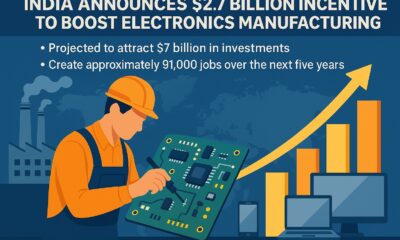

Tech2 months ago

Tech2 months agoIndia Unveils $2.7 Billion PLI Scheme to Boost Electronics Manufacturing and Job Creation